OUR STORY

Timing Carbon Asset Management is a leading emission trading and climate neutral service provider. Through trade and international partnerships, we help companies all over the world contribute to a greener economy and a more sustainable future. We are qualified and certified to trade every classification of carbon asset including clean development mechanism (CDM), the international voluntary emission reduction standard (VCS), the gold standard (Gold Standard), and the development of the international renewable energy certificate (I-REC), also the development of the nature based solution (NBS) projects.

Our management branch, Beijing Timing Jiye Investment Consulting Company Ltd, specialises in the trading of China's voluntary emission reductions (CCER) and the carbon asset management business. Working with leading financial institutions the branch is actively involved in developing carbon financial derivatives and emissions trading. It is a certified member of nine pilot emission exchanges across China.

With offices in both Beijing and Shanghai and Singapore, Timing Carbon Asset Management has a presence in the major cities for carbon asset development and the promotion clean technology. With a wealth of experience in the sector, a professional legal team and strong financial backing we offer our clients a high degree security and the expert guidance needed to navigate the complexity of carbon asset trading.

OUR HISTORY IN TRADING

Y2007 Founded

Y2018

CER: 4million tons CER supplied to European carbon market

Y2008-Y2013

key carbon credit supplier

under Kyoto Protocol Mechanisms

Y2014

Allowance: 30%+ market share in 4 major market

CCER: 500,000+ tons CO2 transaction volume

Beijing, Shanghai, Tianjin and Shenzhen

20% market share of CCER clearance

Y2015

Allowance:10% market share in the national market

CCER:13% of national market

Y2016

Beijing Allowance:30% transaction volume during compliance period

Allowance:10% transaction volume in the national market

CCER:13% transaction volume in the national market

Y2017

Allowance transaction:

159.03% increased compared with the same period in 2016.

Y2019

Allowance transaction:30% of the national market

Y2020

Allowance transaction:30% of the national market

In 2018, Supply of 4 million tons of certified emission reduction (CER) for China's CDM project to the European carbon market.

In 2016, Taiming Beijing quota accounted for about 30% of the total transaction volume during the performance period, and the quota transaction volume accounted for 10% of the national transaction volume; CCER transaction volume accounted for about 13% of the total number of pilot markets nationwide.

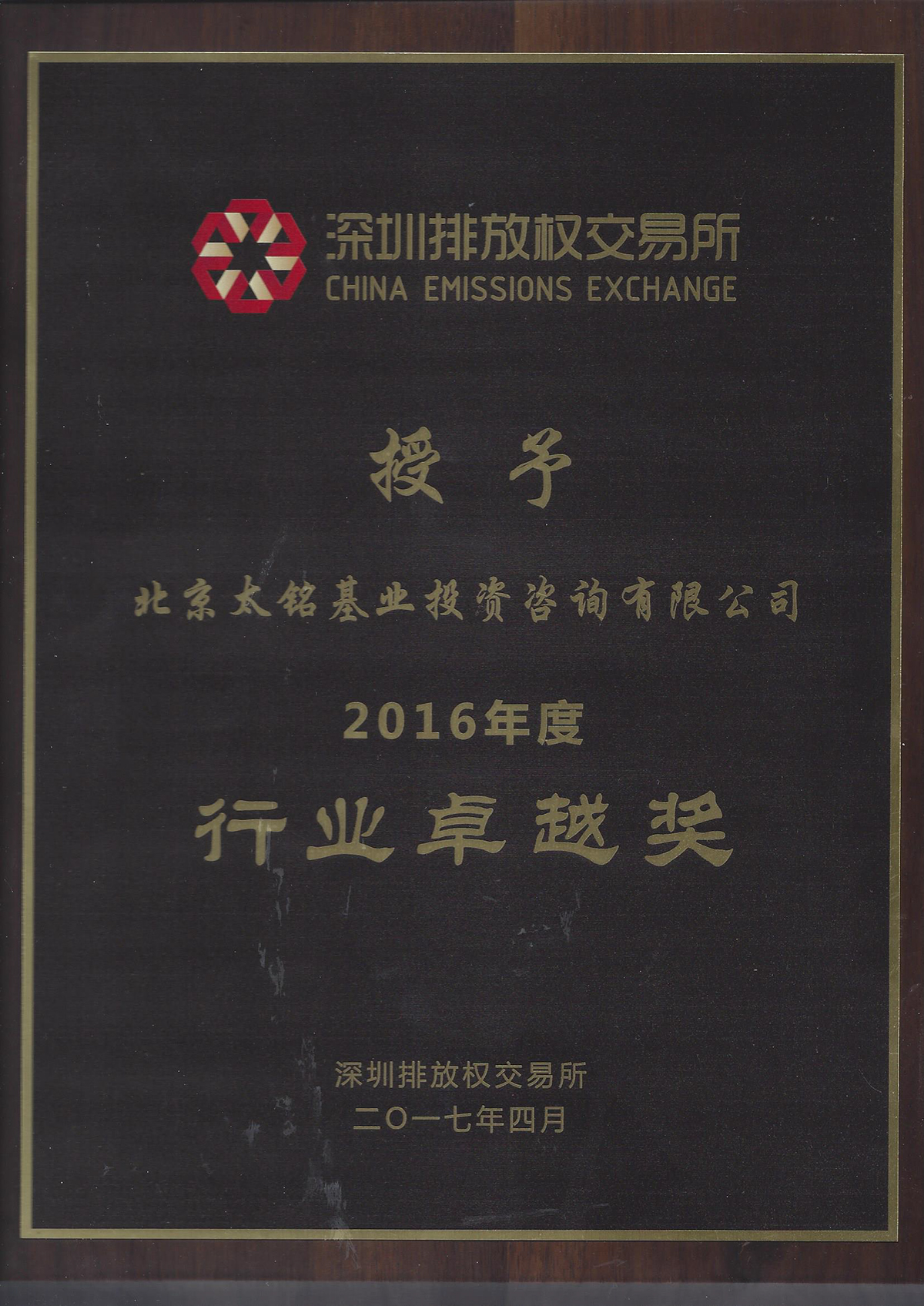

OUR HONOR

• 2015-2019 Excellent member of Beijing Environment Exchange

• 2016-2018 Excellent member of Shanghai Energy Exchange

• 2016 Beijing Environment Exchange Market Development Award

• 2017 Vice Chairman of the Strategic Coordination Development Committee of Shenzhen Emissions Exchange

• 2019 Best Market Contribution Award of Guangzhou Carbon Emissions Exchange

• World Bank International Finance Corporation (IFC) China Carbon Market Review Special Invited Organization

• Council Member of New Energy Chamber of Commerce of All-China Federation of Industry and Commerce

WHAT WE DO

QUICK LINKS

OUR PROJECT